Creating Habits That Lead to Personal Growth

Creating habits that lead to personal growth can be an incredibly powerful tool for transforming a person’s life, both financially and personally. Habits are an essential part of our lives, as they are the foundation upon which we build our behaviors. With the right habits in place, we can take control of our lives and create meaningful changes that will have a lasting impact.

A habit is simply a behavior that has become automatic and is done without thought. It is something that is repeated regularly, and eventually becomes a part of our daily routine. Establishing habits that lead to personal growth and financial success requires a conscious effort. It requires dedication, discipline, and focus, but if done correctly, it can have a massive, positive impact on our lives.

The first step towards creating habits that lead to personal growth is to identify areas of your life that need improvement. This could be anything from improving your diet, to increasing your savings, to organizing your workspace. Once you have identified areas of your life that need improvement, the next step is to develop a plan of action. This plan should include specific goals and actionable steps that will help you achieve your desired outcome.

Once you have identified your goals and developed a plan of action, it is time to start implementing it. This means taking the necessary steps to make your plan a reality. This could be anything from creating a budget, to planning meals, to setting aside time for exercise. The important thing is to stay consistent with your efforts and to create a habit of action.

Creating habits that lead to personal growth is also about setting yourself up for success. This means creating an environment where it is easier to stay on track and to make positive changes. This could include setting aside a specific place to work on your goals, eliminating distractions, or creating a schedule that allows you to focus on the task at hand.

Finally, creating habits that lead to personal growth also means being willing to take risks and try new things. This could be anything from investing in the stock market, to starting a business, to taking a class. Taking risks can sometimes be scary, but it can also lead to great rewards.

Creating habits that lead to personal growth and financial success is not an easy process, but it is one that is well worth the effort. With dedication and focus, you can create lasting positive change in your life and achieve the financial success you desire. By taking the necessary steps to create habits that lead to personal growth, you can start to see the rewards of your hard work and dedication.

The Science Behind Habits

Habits are powerful forces in our lives that can have major impacts on our personal growth and financial transformation. We often think of habits as small actions, such as brushing our teeth or exercising regularly, but the science behind them is actually much more complex. Habits are the result of neurological pathways created by our brains in order to automate certain behaviors. To create a new habit, we must consistently repeat the same behaviors until our brains form new neural pathways, allowing us to repeat those behaviors without conscious effort.

The power of habits can be seen in our personal growth and financial transformation. Habits enable us to develop new skills and acquire new knowledge with relatively little effort. We can create powerful habits that help us stay focused and productive, allowing us to take on new challenges and achieve greater success. Habits also allow us to prioritize our finances, enabling us to save money and invest for the future. With the right habits in place, our financial transformation can become a reality.

At the same time, habits can be difficult to break. We can become so accustomed to certain behaviors that it can be hard to break free of them. We can also become stuck in cycles of bad habits that prevent us from reaching our full potential. To break these bad habits, we must replace them with new, positive habits that support our goals. It takes time and effort, but breaking bad habits and creating new ones can have a dramatic impact on our lives.

The science behind habits is complex, but the potential for growth is immense. With the right habits in place, we can unlock our potential, enabling us to reach our goals and achieve financial transformation. It takes discipline and dedication, but with the right mindset, habits can become powerful tools that drive us towards success. With the right habits, we can unlock our potential and achieve unparalleled success.

Building Habits for Financial Transformation

Habits are a powerful tool for personal growth and transformation. Everyone has their own unique habits that they have developed over time, and these can be used to create a better life. When it comes to financial transformation, building good habits can be a great way to achieve that goal.

Good financial habits are like a muscle; the more you exercise them, the stronger and better they become over time. Developing habits that focus on financial transformation can help you create a secure future for yourself and your family. Start by setting up a budget and sticking to it. This will help you understand where your money is going and how to best use it. Additionally, create a plan for long-term financial goals such as saving for retirement, paying off debt, or investing in the stock market.

Another great habit to develop is to practice mindful spending. Being mindful of where your money is going will help you better manage your finances and help you avoid impulse purchases. Taking the time to analyze purchases before you make them will help you make smarter decisions about where your money is going and how to best allocate it.

In addition to mindful spending, developing a habit of tracking your expenses can be very helpful in achieving financial transformation. Budgeting and tracking your expenses will help you gain a better understanding of where your money is going and how to better manage it. Create a spreadsheet or use a budgeting app to help you track your spending and to stay on top of your finances.

Finally, it’s important to recognize that financial transformation is a long-term process. It takes time to build these good habits and to see the results of your efforts. But with patience and dedication, you can make significant progress towards achieving your financial goals.

By developing good financial habits, you can create a strong foundation for personal growth and financial transformation. Take the time to create a budget, practice mindful spending, and track your expenses. Doing so will help you gain a better understanding of your finances and will put you on the path to achieving your financial goals. With dedication and patience, you can begin to see the results of your efforts and make progress towards financial transformation.

Benefits of Established Habits

Establishing habits can be one of the most powerful tools for personal growth and financial transformation. Our habits can form the foundation for our actions, and understanding the benefits of established habits can help us to take control of our lives and shape our future.

The most fundamental benefit of established habits is that they help us to stay focused on our goals. When we have a habit in place, we are more likely to stay on track and take consistent action towards our goals. For example, if we have a habit of setting aside a certain amount of money each month into savings, then we are more likely to save money and reach our financial goals. Having an established habit of setting aside money each month relieves us of the burden of having to make a conscious decision each month to save money.

Established habits also provide us with a sense of comfort and stability. By having a set of habits in place that we practice each day, we can rely on our habits to provide structure and comfort in our lives. This can help us to maintain a sense of balance and peace, even when things seem chaotic and uncertain.

Having established habits can also help us to stay motivated. When we have positive habits in place, such as exercise, journaling, and reading, we are more likely to stay motivated and engaged in our goals. We can use these habits as a reminder of our goals and keep us on the right track.

Furthermore, having established habits can help us to make better decisions. When we have a habit in place, we are less likely to make rash decisions out of fear or impulsiveness. Established habits can provide us with the structure and guidance to make more informed decisions and ultimately reach our goals.

Finally, having established habits can help us to save money. When we have an established habit of budgeting, we are more likely to make smart financial decisions and save money in the long run. Established habits can also help us to prioritize our spending and keep our spending habits in check.

In conclusion, establishing habits can be one of the most powerful tools for personal growth and financial transformation. Established habits can help us stay focused, provide us with a sense of comfort and stability, motivate us, and help us to make better decisions. Ultimately, having established habits can help us to save money and reach our financial goals.

Overcoming Challenges with Habits

Habits are powerful tools that can help us achieve personal growth and financial transformation. They can help us break through the barriers of fear, anxiety, and procrastination to reach our goals. However, even though habits are a powerful tool, they are not always easy to establish. It takes effort and discipline to create and maintain habits that will lead to success.

The key to overcoming the challenges of habit formation is to start small and build up gradually. Start by identifying the areas of your life that you want to improve, such as your health, relationships, or finances. Then decide on a few simple habits that you can develop to improve those areas. For example, if you want to improve your finances, you can start by setting aside a small amount of money each month for savings.

Once you have identified the habits you want to start, it is essential to create a plan for implementing them. This plan should include specific steps to help you stay on track. For example, you can set reminders on your phone or calendar to remind you to perform the habit each day. You can also enlist the help of a friend or family member to help you stay accountable.

When it comes to creating habits, it is important to be realistic. Don’t try to set too many goals at once, as this can be overwhelming and lead to failure. Instead, focus on one or two habits at a time and build on them as you get more comfortable.

Once you have established a few habits, it is time to evaluate your progress. Take a look at how far you have come and what you have accomplished. Celebrate these wins and use them to motivate yourself to keep going.

Finally, remember that habits take time to form. It can be challenging to stick to them and it is important to be patient and consistent. Habits take time to form, but when you do, they can lead to significant personal growth and financial transformation. With patience, dedication, and consistency, you can overcome any challenge and achieve your goals.

Tracking Your Habits: The Key to Success

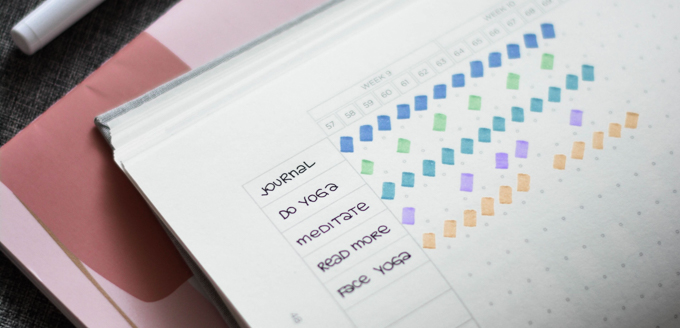

We all have habits in our lives, both good and bad, but one of the most important habits to develop is the habit of tracking our own habits and behaviors. Tracking our habits is the key to success and personal growth, and it can even lead to financial transformation.

When we track our habits, we gain insight into our own behavior and our own patterns. We can see what works and what doesn’t, and we can begin to make changes that will benefit us in the long run. By tracking our habits, we can start to identify areas where we need to make changes, and we can then create a plan to make those changes.

Tracking our habits can help us become more productive and effective in our lives. By tracking our habits, we can identify and eliminate any bad habits that are holding us back from achieving our goals. We can also use the tracking process to develop new, positive habits that will help us on our journey towards success.

Financial transformation can also be achieved through tracking our habits. By tracking our financial habits, we can begin to identify patterns and areas that need improvement. We can also begin to develop new habits that will help us manage our finances and save money. By tracking our financial habits, we can start to make better financial decisions and create a plan to achieve our financial goals.

Tracking our habits can also help us stay accountable and motivated. By tracking our habits, we can easily see our progress and identify any areas that need improvement. We can also stay motivated by setting goals and tracking our progress to reach those goals.

Tracking our habits is a simple yet powerful tool for personal growth and financial transformation. It can help us identify patterns and areas that need improvement, create new habits, and stay motivated and accountable. By tracking our habits, we can become more productive, efficient, and successful in our lives.

The power of habits is undeniable, and tracking our habits is an important step to achieve success and financial transformation. By tracking our habits, we can gain insight into ourselves and our own behavior, develop new habits, and stay motivated to reach our goals. So start tracking your habits today and experience the power of habits for yourself!

The Long-Term Benefits of Habit Building

Habit building is a powerful tool to help you achieve personal growth and financial transformation. When you commit to a set of regular habits, you’re committing to a plan that will give you long-term rewards and success. It may seem like a lot of work at first, but the long-term benefits of habit building can be life-changing.

First and foremost, creating positive and productive habits will help you stay on track and achieve your goals faster. When you make good choices every day and make those choices a habit, you can quickly turn them into a lifestyle. With each positive habit you adopt, you will be one step closer to achieving your goals and fulfilling your dreams.

Good habits also have a positive effect on your finances. When you make it a habit to save money, you will start to see a difference in your bank account. You can start by setting a budget and sticking to it. Once you get into the habit of saving, you can then focus on investing your money in ways that will help you reach your financial goals.

In addition to the financial benefits, habit building can also lead to personal growth. When you consistently practice positive habits, you can build up your confidence and self-discipline. You can also learn to be more mindful and aware of yourself and your surroundings. This will help you stay focused and motivated as you work towards your goals.

Finally, habit building can help you become more organized and productive. When you make a habit of setting goals and breaking them down into smaller tasks, you will be able to stay on top of your to-dos and prioritize better. This will help you stay organized and get things done more efficiently.

Overall, the long-term benefits of habit building are undeniable. When you make it a habit to practice positive and productive habits, you will be able to achieve your goals and reach your dreams faster. You will be able to save money, become more organized and productive, and enjoy more personal growth. So start today and see how habit building can transform your life.

Getting Started With Habit Development

Habits are powerful tools that can help us to achieve our goals and transform our lives. They can help us to become healthier, more productive, more successful, and even wealthier. But how do we get started with habit development? It can be overwhelming to think about changing your life and developing new habits, but there are some simple steps you can take to get started.

The first step is to recognize the power of habits and the impact they can have on your life. Think about the areas where you want to make changes and create goals for yourself. Once you have a clear vision of what you want to achieve, breaking it down into manageable steps will make it easier to actually achieve it.

The second step is to create a plan. Write down what you want to accomplish, when you want to do it, and the steps you need to take to get there. Having a plan gives you a roadmap to follow and keeps you focused on your goals.

The third step is to start small. Focus on one habit at a time and create a plan for it. Make sure that your plan is realistic and achievable. Don’t be afraid to take baby steps and celebrate your successes along the way.

The fourth step is to create an environment of success. Surround yourself with people who will support and encourage you in your habit development. Connect with mentors, join a support group, or take a class that will give you the tools you need to reach your goals.

The fifth step is to stay on track. Remind yourself why you’re doing this and what you’re trying to achieve. Celebrate your successes and don’t be too hard on yourself when you have setbacks. It’s important to stay persistent and consistent in your habit development.

The sixth step is to reward yourself. It’s important to recognize your progress and celebrate your successes. Having rewards for yourself will help you stay motivated and keep you going even when things get tough.

Finally, the seventh step is to stay focused and keep learning. Habits take time to develop, so don’t expect overnight success. Keep learning about the power of habits and how to use them to your advantage.

Habit development is an important part of personal growth and financial transformation. It can be intimidating to get started, but by following these steps and creating a plan, you can get on the path to success. Habits are powerful tools that can help you create the life you want, and with the right approach, you can make a real difference in your life.

Breaking Bad Habits: Taking Control

The power of habits is often overlooked as a tool for personal growth and financial transformation. But it can be a powerful force when used correctly. Habits, both good and bad, shape our lives in many ways. And it’s up to us to decide which habits we want to keep and which ones we want to break. Breaking bad habits is an important part of personal growth and financial transformation.

When it comes to breaking bad habits, it’s important to understand why these habits have been developed in the first place. It could be due to a lack of self-control, a need to fit in with a particular group, or simply a lack of awareness of the impact of our habits. Whatever the cause, it’s important to understand it and address it in order to break the habit.

The first step in breaking bad habits is to identify them. This can be done by taking an honest look at our behaviors and recognizing when we are engaging in bad habits. Once we have identified our bad habits, we can start to take control and work on breaking them.

The next step is to replace the bad habit with a good one. This could be something as simple as replacing a habit of overeating with a habit of exercising. Or it could be something more complex such as replacing a habit of procrastination with a habit of self-discipline. Whatever the replacement habit is, it’s important to set realistic goals and stick to them.

Breaking bad habits also requires a strong support system. Friends and family can provide encouragement and advice when we are struggling to break a habit. It’s also important to find positive role models who have been successful in breaking bad habits. They can provide valuable insight into the process and can help us stay motivated.

Finally, it’s important to remember that breaking bad habits is a process. It takes time and effort to break a habit and it’s not something that can be accomplished overnight. It’s important to be patient and to keep trying even when we feel like we are not making progress. With patience and dedication, we can break bad habits and take control of our lives.

Breaking bad habits can be a difficult process, but it’s one that can have a huge impact on our lives. It can lead to improved personal growth and financial transformation. With the right attitude and the right support system, we can break bad habits and take control of our lives.