Investing in Yourself

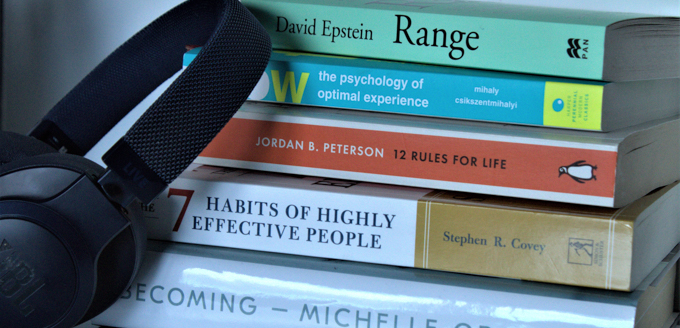

Investing in yourself is one of the most important life hacks for building wealth and personal growth. After all, it’s impossible to grow your finances if you don’t grow as an individual. As an investor, you must look beyond the stock market and focus on yourself.

The most successful investors have mastered the habit of investing in themselves. One of the most important life hacks for building wealth is to invest in yourself first. Take the time to learn new skills, take classes, and attend seminars. Investing in yourself means investing in your knowledge, skills, and abilities. Learning new skills will give you the confidence to take on more challenges and increase your income potential.

Another life hack for building wealth and personal growth is to make time for yourself. Make sure you have time for activities that bring you joy and relaxation, such as yoga, meditation, or taking a walk outside. Taking a break from your daily routine can help you recharge and be more productive, which will ultimately lead to more wealth.

Finally, one of the most important life hacks for building wealth and personal growth is to surround yourself with the right people. Surround yourself with individuals who have similar goals and values and who can motivate and inspire you to reach your financial and personal goals. Networking with the right people can open up doors and provide you with invaluable advice and resources.

Investing in yourself is one of the greatest life hacks for building wealth and personal growth. When you invest in yourself, you are investing in your future. You are taking the time to gain knowledge, skills, and abilities that will help you achieve financial success. You are also taking the time to relax, recharge, and network with the right people. All of these life hacks for building wealth and personal growth will help you take control of your finances and ultimately lead to increased wealth.

Making Smart Spending Choices

Making smart spending choices is the key to achieving wealth and personal growth. It’s easy to get caught up in the excitement of shopping and spending money, but it’s important to remember that every purchase you make has an impact on your budget and your future.

The best way to ensure that you’re making smart spending choices is to create a budget and stick to it. Start by tracking your income and expenses for a month to get an idea of where your money is going. Then, create a budget that allows you to save money for your future goals and still provides for your current needs.

When it comes to spending, it’s important to be mindful of your purchases. Before you make a purchase, ask yourself if the item is a need or a want. Do you really need it? Is it something you can live without? Is there a cheaper alternative? If you can’t answer yes to all of these questions, it’s best to wait and think it over.

It’s also important to be mindful of where you’re shopping. Choose stores and websites that offer discounts and rewards. Look for coupons and promo codes that can help you save money. Consider shopping second-hand to get items for less.

In addition to being mindful of where you shop, try to pay in cash whenever possible. Paying with cash can help you stay on budget and avoid racking up debt. If you’re trying to save money, you can even divide your cash into envelopes so you know exactly how much you have to spend in each category.

Finally, don’t forget to take advantage of the freebies. There are plenty of free or low-cost activities that can help you build wealth and personal growth, such as attending free seminars, reading books from the library, or taking classes online.

Making smart spending choices is an essential life hack for achieving wealth and personal growth. By creating a budget, being mindful of your purchases, shopping smart, and taking advantage of free activities, you can save money and reach your financial goals.

Creating a Solid Financial Plan

Creating a solid financial plan is essential for building wealth and achieving personal growth. It’s not enough to just set a goal; you need to have a plan of action in order to reach it. A financial plan is not something you should create overnight; it takes time and effort to ensure that your plan is tailored to your goals and lifestyle. Here are a few tips to help you create a solid financial plan:

- Start with a budget. Establishing a budget is the foundation of any financial plan. Knowing how much money is coming in and how much is going out is essential in developing a plan to build wealth. It’s important to take a realistic look at your income and expenses to ensure that your budget is achievable and sustainable.

- Set realistic goals. When creating a financial plan, it’s important to set realistic goals that are achievable in the short and long-term. It’s also important to consider the time frame in which you want to achieve your goals. Having a clear timeline will help you determine how much money you need to invest and how much you need to save.

- Utilize the right tools. There are a variety of financial tools available to help you create and manage your financial plan. From budgeting apps to investment calculators, there are a variety of tools available to help you make informed decisions. Take advantage of these tools to ensure that your financial plan is tailored to your needs.

- Automate your savings. Automating your savings is an effective way to ensure that you are consistently putting aside money for the future. Consider setting up automatic transfers from your checking account to your savings or investing accounts. This will help you save money without having to think about it.

- Consider hiring a financial advisor. If you find that you need additional help in creating and managing your financial plan, consider hiring a financial advisor. A financial advisor can help you to create a plan that aligns with your goals and lifestyle and provide guidance and support throughout the process.

Creating a solid financial plan is essential for building wealth and achieving personal growth. It’s important to create a budget, set realistic goals, utilize the right tools, automate your savings, and consider hiring a financial advisor. By following these tips, you can create a plan that is tailored to your needs and help you reach your financial goals.

Identifying Your Financial Goals

It’s easy to feel overwhelmed by financial decisions and goals. After all, money is a complex subject, and you want to make sure you’re making the right decisions for your future. That’s why it’s important to take the time to identify your financial goals. When it comes to building wealth and personal growth, having a clear direction is key.

Start by asking yourself what your ideal financial future looks like. Do you want to retire early and travel the world? Do you want to save up to buy a house? Do you want to create a college fund for your children? Identifying your goals can help you determine the steps you need to take to make them happen.

Once you have a clear idea of what you want, you can start breaking down your goals into smaller, more manageable pieces. For example, if you want to retire early, you could create a retirement savings plan. If you want to buy a house, you could set a budget and research the local housing market.

Creating a personal budget is also essential for building wealth and personal growth. A budget can help you identify areas where you can save and determine how much you can afford to invest. When it comes to budgeting, it’s important to be realistic. Don’t make promises that you can’t keep and don’t underestimate how much you need for emergencies.

Finally, it’s important to track your progress. Set up a system to monitor your finances and track your spending. This will help you stay on track and motivated as you work towards your goals. You could also set up a system to remind you when it’s time to review your goals and make adjustments.

Identifying your financial goals is an important step in building wealth and personal growth. By taking the time to create a plan and track your progress, you can ensure that you’re on the right path to achieving your goals. With a clear direction and consistent effort, you can create a secure financial future for yourself and your family.

Using Budgeting Apps and Tools

Budgeting is a key factor to building wealth and achieving personal growth. It can be difficult to stay organized and on top of your financial goals. Fortunately, budgeting apps and tools are available to make it easier.

Using budgeting apps and tools, you can easily track your income, expenses, and budget goals. You can set up monthly or weekly goals and track your progress towards them. You can also set up alerts when you reach a certain spending threshold. This will help you stay on top of your budget and ensure that you don’t overspend or miss payments.

Budgeting apps and tools are also great for tracking your investments. They will provide you with real-time updates on your portfolio and help you make informed decisions about your financial decisions. You can also use budgeting apps and tools to find and compare investment options, making it easier to find the best investments for your goals.

Budgeting apps and tools also allow you to easily manage your debt. You can track when payments are due and keep an eye on your credit score. This will help you make smarter decisions about how to manage your debt and will help you stay on track to becoming debt-free.

Budgeting apps and tools are also great for setting financial goals and tracking your progress. You can set up short-term and long-term goals and track your progress towards them. This will help you stay motivated and on track to achieving your financial goals.

Overall, budgeting apps and tools are a great way to stay organized and on top of your financial goals. They provide you with real-time updates, help you make informed decisions, and allow you to easily manage your debt. They are a great way to stay motivated and on track to achieving your financial goals.

Understanding Your Credit Score

Your credit score is an important tool for building wealth and personal growth. It is a key indicator of your financial health and can directly impact your ability to access credit, make purchases, and even secure employment. Knowing your credit score and having an understanding of the components that make it up can be beneficial in helping you reach your financial goals.

The first step in understanding your credit score is to familiarize yourself with the different types of scores. The most commonly known credit score is the FICO score, which ranges from 300 to 850. This is a numerical representation of your creditworthiness and is used by lenders to decide whether or not to approve your loan or credit card applications. In addition to the FICO score, there are also VantageScores which range from 501 to 990 and FactorTrust scores which range from 300 to 850.

Once you are familiar with the different types of scores, you should then understand the components that make up your credit score. Your score is determined by five factors: payment history, credit utilization, credit age, credit mix, and new credit. Payment history is the biggest contributing factor and accounts for 35% of your score. This includes whether or not you make your payments on time, how often you make late payments, and the amount of debt you have in collections. Credit utilization is the second most important component and is determined by the amount of debt you owe relative to the amount of credit you have available. This accounts for 30% of your score. The other factors, credit age, credit mix, and new credit, account for 15%, 10%, and 10% of your score, respectively.

Having an understanding of the components that make up your credit score can help you make better financial decisions. You can use this information to work towards improving your score and increasing your chances of approval for credit cards, loans, and even job applications. Simple steps like paying your bills on time, staying within your credit utilization ratio, and keeping your credit age high can go a long way in helping you reach your financial goals.

The best way to monitor your credit score is to use a credit monitoring service. This will give you a detailed report of your credit score and activities, and should be checked regularly to ensure accuracy and detect any potential fraudulent activity. You also have the right to request a free copy of your credit report each year from each of the three major credit bureaus. This can provide you with valuable information about your credit history and is a great way to monitor your score and spot any discrepancies.

Understanding your credit score is an important part of your financial health and can be beneficial in helping you reach your financial goals. Knowing the different types of scores, the components that make up your score, and how to monitor it can help you make more informed decisions and take control of your financial life.

Seeking Professional Financial Advice

As we continue to strive for financial success and personal growth, it is important to seek out professional financial advice when needed. Taking the time to research and consult with experts can be a smart move that can help you make the most of your money. After all, financial success and personal growth go hand-in-hand.

When it comes to financial advice, there are a few key factors to consider. First of all, make sure to research the professional you are considering. Check their credentials, qualifications, and references. It is important to make sure they are someone you trust and feel comfortable with. Secondly, determine what type of advice you need. Do you have questions about investments, retirement planning, or budgeting? Knowing what kind of advice you are looking for can help narrow down your search.

Once you have found a professional financial advisor who you trust and feel comfortable with, the next step is to understand what to expect from the relationship. Ask yourself if you want short-term advice, such as a one-time consultation, or if you are looking for a long-term relationship. Knowing your expectations can help you decide the best approach. In addition, it is important to understand the fees associated with the services. Make sure you have a clear understanding of the cost structure before entering into an agreement.

Having a professional financial advisor can be a great asset in helping you reach your financial goals. A good advisor will take the time to understand your financial goals and develop a tailored plan to help you reach them. They will be able to provide guidance and advice on how to invest, manage debt, and budget effectively. They can also help you develop strategies to protect your assets and plan for the future.

Though it may be tempting to go it alone, seeking professional financial advice can be a great way to increase your chances of success. It is important to take the time to do your research and find someone who you can trust and who is knowledgeable about the specific area you are looking for advice on. With the right professional by your side, you can be well on your way to wealth and personal growth.